Avoid These Money Mistakes In The New Financial Year

Stepping into the new financial year 2023-24, it is really important to look at and be aware of the very common mistakes that can cost you very much. From not investing adequately for the future to overspending on your credit cards to not reviewing your tax reports to delaying tax planning. Below mentioned are the various money mistakes one should avoid in the new financial year.

Money mistakes to be avoided in the new financial year

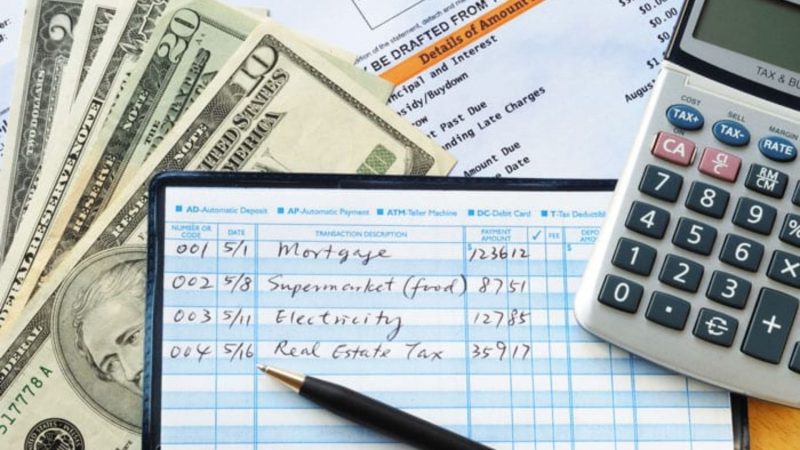

Not Maintaining Enough Budget

A budget is an integral part of planning your financial expenses. If you don’t create a budget you will never realize the importance of financial planning. If you don’t create a budget you will end up spending more than you planned. And it would really difficult to go ahead with your financial goals and would never know about the inflow and outflow you are spending every month and where it goes.

For making your process easy, various applications can help you plan your budget and your spending easily. Some of the banks also provide this feature in their mobile application itself. You have a choice to create a spreadsheet for your budgets, this will also help you cut down your various unnecessary expenses. Planning and maintaining your budget judiciously is very important.

Not Maintaining Emergency Funds

Has it ever happened to you that you end up spendings all your earnings without saving for future emergencies? It could be a job loss, medical bills, accidents, or various repairs that result in demanding huge amounts of funds. You are going ahead without maintaining the emergency funds will result in more debt on you. This is why it is important to maintain some emergency funds to avoid taking high-interest loans.

You may want to start cutting your expenses or avoid impulsive buying that you don’t need. You can also start saving a part of your monthly income for emergency situations. This will help you to be prepared for unexpected and unforeseen events.

No Saving Plans

The right financial freedom starts when you are saving more than your earning or spending. Whether the savings are for emergencies or saving a little extra for your future expenses. It is really difficult to survive on paychecks or when you don’t have adequate savings. However, it is very easy to spend all your money on various bills and expenses forgetting about the savings for the future.

You can automatically save money by automatically withdrawing money from your main account to your savings account on your salary day which will also not make you feel the burden of cutting down on your expenses later. Adding your money to your savings account would also help you earn extra savings on the amount you saved in your savings account. You should also keep the money for purchasing big things such as houses, cars, home gadgets, etc.

Not Tracking Your Expenses

Making a great budget is not enough unless you don’t track your expenses properly. It is very important to track your budget 3-4 months before you plan your budget. This would give you a clear picture of how much you are spending on groceries, food, clothing, etc and this will prove really helpful to you while planning your budget.

Tracking your budget and your expenses would help you in creating a realistic budget for yourself. This will help you stay ahead of your bills and cut down on the various necessary spending and help in saving more and more for you. There are various applications available that can help you track your expenses.

Impulsive Buying

One of the main financial mistakes to avoid is impulsive buying. Impulse buying refers to spending on goods and services that you did not plan to do so. Impulse buying is an antonym to savings and budgeting. Impulse buying can dig a deep hole in your pockets resulting in no or very little savings and giving you a tight budget for upcoming events. Impulsive buying can result in opting for high-interest-rate loans, and unplanned borrowings which would result in damaging your financial health in long run.

Recurring Loans And Borrowings

A few borrowings from here and there are quite okay but when the borrowings land you in debt can lead you the financial problems. Whether you are borrowing it from your friends, family, or financial institutions, all the borrowings should be done in a restricted way, it is a great idea to ask for money whenever you have stuck in any emergency or you require money for your expenses and this will lead to more debt on you.

Ignoring all the Investments

Investments are a great way to make more wealth and make more money for yourself over time. Several types of investments can help you crush your financial goals. To work safely you can start with some low-risk investments which include investments in agriculture, company shares, and stocks. But remember that investing in low-risk investments will also give a low return on investments but if you have more money then you can try investing in real estate as it will give you more value in the coming years.

Ignoring the Retirement Plan

It is very easy to ignore all the retirement investments but if you start investing little by little in these retirement investments that can result in growing your money with compounding. You can save for your retirement in many ways such as by setting up small or medium size businesses, opening multiple income streams, opening a pension account, and many other ways. A pro tip is to avoid borrowing funds from the retirement account. Although you can take some money out at time emergencies or when you are struggling to pay your bills and expenses but this should not be done in the loop for the longer run.

Frequently Asked Questions

What are the biggest financial mistakes one should avoid?

How can you avoid these financial mistakes?

What are the main financial risks?

What are the most common budget mistakes?

What are the main factors affecting your budget?

Also Read:

6 Financial Tips for Your 30s for a Better Financial Future