LIC IPO: Details That Policyholders Must Know

LIC IPO: The Biggest IPO Listing of India

Are you ready for the largest ever IPO listing of India? On 13th Feb, the Life Insurance Corporation of India has filed DRHP draft papers to market regulator SEBI.

News to Policyholders

- Policyholders can subscribe to the LIC IPO at a discounted price.

- Further, 10 per cent of the total IPO is reserved for the policyholders. According to the DRHP papers, “The aggregate of reservations for the eligible policyholder(s) shall not exceed 10 per cent of the offered size”.

- Lic policyholders can apply for the IPO with a reserved quota with a simple process.

- Policyholders should link their LIC policy with PAN to avail the special benefits to subscribe to the IPO.

Also read:

SEBI Bans Anil Ambani, 3 Associates For 3 Months

Reserved Quota for Policyholders

Only people that are eligible to apply for the LIC IPO under the reserved quota are those who have one or more than one insurance policy. This means the company is giving complimentary benefits to its existing consumers. Their bid limit is upto 2 lakhs and all the policyholders will have to link their policies to PAN. otherwise, they are not eligible to get special benefits from IPO reserved quota. The last date to do so is 28 February 2022. And also a Demat account is necessary of course.

LIC’s Statement while the IPO was in news “ In order to participate in any such public offering, policyholders will need to ensure that their PAN details are updated in the Corporation’s records. Further subscribing to any public offering in India is only possible if you have a valid DEMAT account”.

Simple Steps To Link Your PAN With Your Policy

- First, open the link

- Provide all the details like DOB, Email, PAN, full name, Mobile Number, and policy number. Just make sure to write all the details correctly.

- Tick the declaration after reading, if you want to.

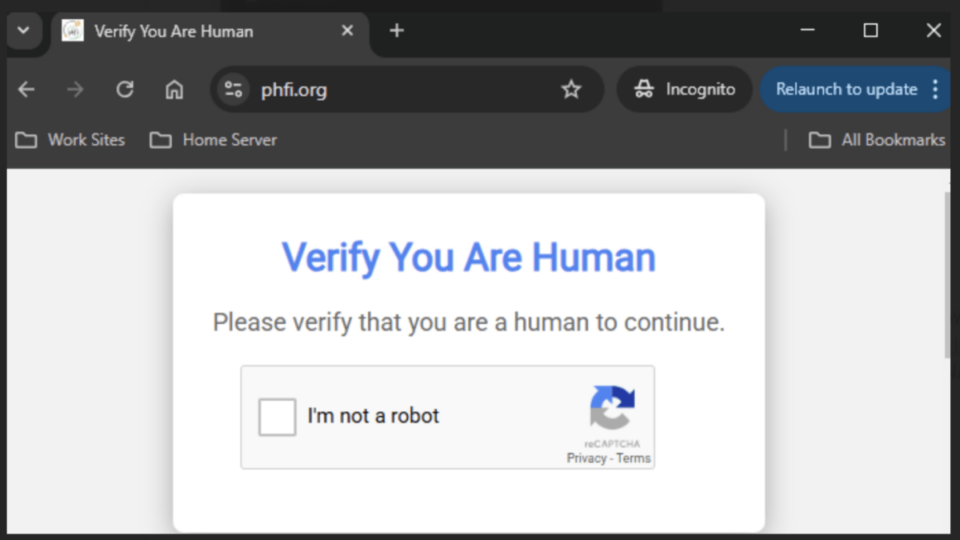

- Then fill out the captcha for verification.

- Request for OTP, you will get the OTP on your registered mobile number.

- Enter the OTP and then submit it.