SBI, HDFC Bank, Know The Latest FD Rates After Second Hike

Since the Reserve Bank of India has gone on a repo rate hiking spree, the major banks in the country are increasing their interest rates on FD deposits and borrowings as well. EMIs and other types of financial instalments have become costlier now, but with the benefit to investors. Investors are now getting more and more interest rates on their accumulated amounts.

RBI’s Latest Hike Influenced SBI, HDFC Bank

On September 30, 2022, RBI last increased their key lending prices, which influenced major banks like SBI and HDFC to increase their interest prices for the second time this month on both deposits and borrowings, which eventually benefited mostly the FD investors.

Let’s take a look at what SBI and HDFC banks have to offer after increasing their FD rates for the second time this month.

Latest SBI FD Rates

SBI’s second hike came into effect on October 22 for the FD deposit plans of less than ₹2 Cr. This time there are specific tenures for which the interest rate is increased by 25 to 80 basis points.

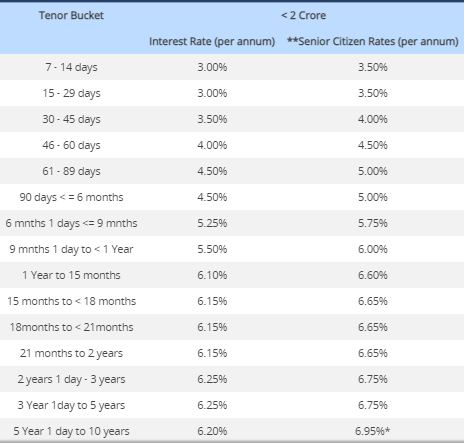

Latest HDFC FD Rates

After the second hike this month, HDFC bank has increased their FD rates by 50 bps which are in effect from October 26, 2022. Revised rates are only applicable for deposits below ₹2 Cr. The previous hike came into effect on October 11, 2022, after which the interest of specific FD tenures were increased by 75 bps.

Also read:

ITR Filing Last Date Is Extended Till November 7 For Companies