These 5 Government Companies Are To Be Privatised This Year

Privatizing Government Companies

Our Government has 5 major companies on its list that are likely to undergo the privatization process. The liquidation target of ₹65,000 Cr has been set by the center for the fiscal year 2022-23. The government has already mapped out the disinvestment plan for both non-strategic and strategic sectors.

Four Companies Are In Queue, One Is Disinvested

Total 5 Government Companies are to be disinvested this year and out of which three on the list are “Bharat Petroleum Corporation Ltd (BPCL), RINL, and Pawan Hans.” Another is Life Insurance Corporation of India (LIC) whose Initial Public Offering (IPO) is coming this month, with which the Government is going to sell more than a 5 percent stake.

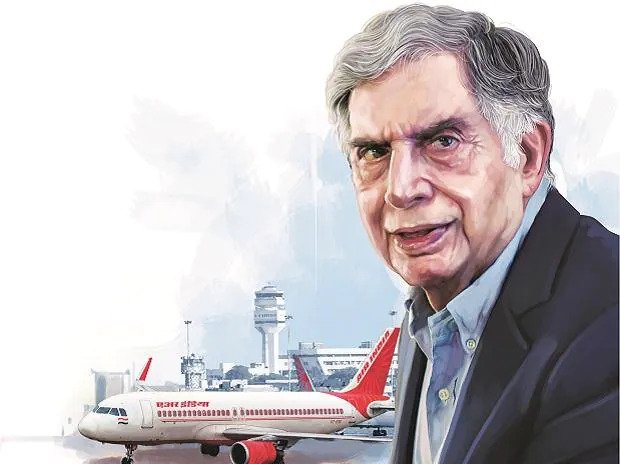

The government’s 100 percent shares in Air India and complete management authority were transferred to Talace Pvt Ltd, a TATA-owned company earlier this year. Neelachal Ispat Nigam Ltd (NINL) is also acquired by the Tata Steel Long Products Ltd, they won the bid as a strategic buyer by ₹12,100 Cr

For the fiscal year 2022-23, the government has set a disinvestment mark of ₹65,000 Cr to achieve as per the Union Budget. Previously for the fiscal year 2021-22, the Government had a target of ₹1.75 lakh Cr of disinvestment out of which they are only able to achieve ₹78000 Cr.

In the budget speech of 2021, Finance Minister Nirmala Sitharaman said, “We have kept four areas that are strategic where bare minimum CPSEs [central public sector enterprises] will be maintained and rest privatized.”

Also read:

LIC IPO To Be Open In Last Week Of April, Know All Detailshttps://www.viralbake.com/lic-ipo-to-be-open-in-last-week-of-april-know-all-details/

LIC IPO

LIC IPO may launch at the end of April. “It is all set to be launched in the last week of April. And now the Government is also planning to increase the share of 5 percent stake which it has planned earlier to sell through Public Issue. The recent incidents such as the Russia-Ukraine war have created an adverse impact on the Stock Market and have provoked the government to consider increasing the size of this largest IPO after.”