These Savings Bank Accounts Offer Higher Interest Rate Than Bank FD

Fixed Deposits aka FDs are a giving but a long affair. You need to pay a premium for a good number of years to get the best returns after some 10-15 years. However, in recent months, the RBI has lowered the repo rate, which has prompted banks to lessen the interest rates on fixed deposits.

Banks and financial institutions, as per reports, are currently healthy enough to offer only a mere 2.5%-5.5% of interest rate on fixed deposits. Well, this might inspire you to look for a different investment option and here, savings accounts come to the rescue.

Also Read: Emotional PM Modi Launches Vaccination Drive, Sanitation Worker At AIIMS Receives 1st Shot, Watch

Despite the pandemic, some private banks and small finance banks are offering between 3% and 7.25% interest if you are ready to maintain a specific amount of average balance in your savings account.

Also, for the unaware, the interest amount earned from fixed deposits and savings accounts is usually taxable. However, as per Section 80TTA, a deduction of Rs 10,000 is offered in interest income earned from the savings account.

Here are saving banks that offer higher interest than a bank FD

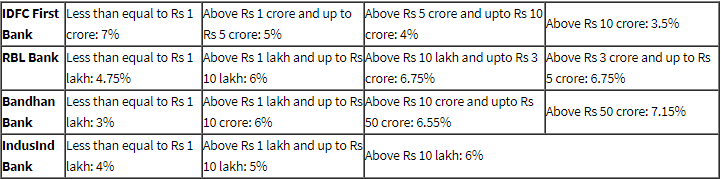

Private Sector Banks

Also Read: Adat Se Majboor: Steve Smith Caught Cheating Again As He Removes Rishabh Pant’s Guard Marks

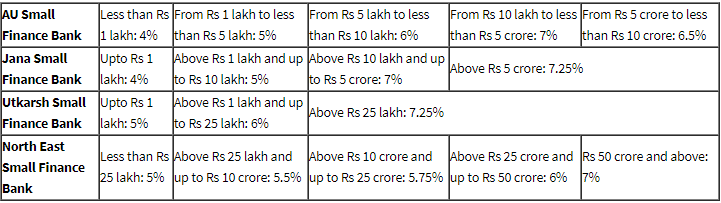

Small Finance Banks

Also Read: Padharo Mhare Desh: 20 Exciting Things You Can Do In Jodhpur

Feature image source – The Financial Express