Best Credit Cards with Big Cashback Rewards on Rs. 1 Lakh Purchases

Credit cards have various advantages that make them appealing. One of them is expense refund. When consumers use their credit cards to make purchases, a percentage of the transaction amount is credited to their account. It’s a precise method for customers to reap genuine rewards depending on their spending. Every card gives a certain percentage of cashback on each purchase, depending on the provider.

The cashback is usually paid to your credit card account and applied to your next payment. Below we have mentioned five credit cards that give decent cashback, assuming that you intend to spend around a lakh.

Best Credit Cards with Big Cashback Rewards

1. SBI Cashback Credit Card

This card provides 5% cash back on internet purchases and 1% cash back on offline purchases. If you spend ₹20,000 online and the rest offline, you will collect ₹21,600 in cashback every year.

2. HDFC Millenia Credit Card

This card provides 5% cashback on Amazon, BookMyShow, Cult. fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato purchases, as well as 1% cash back on all other purchases. Assuming a monthly split of ₹20,000 and ₹80,000, the yearly cashback amounts to ₹21,600.

3. Axis Bank Ace Credit Card

It gives a 5% return on bill payments, 4% back on Swiggy, Zomato, and Ola, and 2% back on all other purchases. Assuming a monthly expenditure of ₹10,000 on bill payments and categories with 4% cashback and ₹90,000 on other purchases, the cashback for the year is ₹20,400.

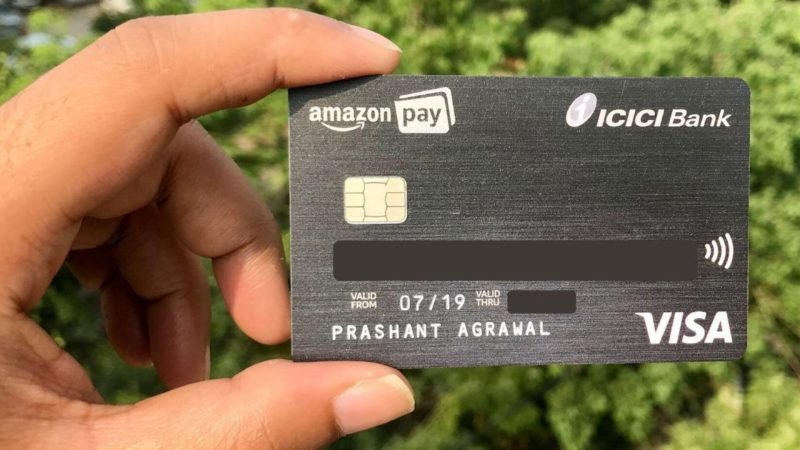

4. ICICI Amazon Pay Credit Card

This card gives 5% cashback on Amazon India purchases, 2% cashback on Amazon Pay payments, and 1% cashback on all other purchases to Prime members. Assuming you spend ₹10,000 on Amazon India and ₹20,000 to ₹70,000 elsewhere, you will receive a cashback of ₹19,200 every year.

5. Standard Chartered Smart Credit Card

The card provides a 2% reward on online purchases and 1% cashback on all other purchases. Assuming you spend ₹50,000 online and ₹50,000 elsewhere each month, your payback for the year is ₹18,000.

In India, several credit cards provide additional points or payback for certain categories such as dining, grocery, petrol, or online shopping. To receive the maximum benefits from cashback and incentives, however, you must pay your credit card payment in full and on time. Late payments might result in excessive interest costs that can easily surpass the value of any awards received.