e-PAN Card: Download In These Simple Steps

PAN Card is one among the most important Government issued ID Cards along with Aadhaar Card. It helps businesses, salaried individual to file their taxes and income tax returns. Apart from this you need to have PAN Card at all places where there is a financial transaction happening. There is a rule in banks where if you have to deposit Rs 50,000 or more you need to produce your valid PAN Card. You can now also produce e-PAN Card to banks for such transactions.

Government keeps an eye on all financial transactions happening in the country through PAN Card. But there are chances that you might need your PAN Card for a transaction but you have either lost it or left it at home. In such cases earlier you had to postpone your work for another day. Now you can download an e-PAN Card in few simple steps.

Steps To Download e-PAN Card

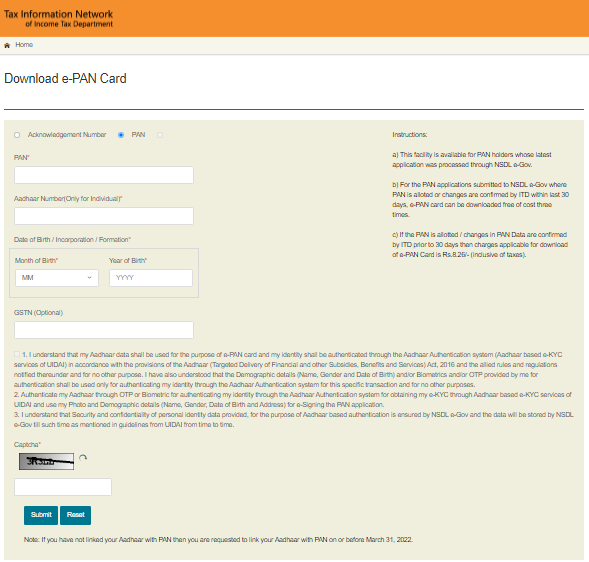

- Visit Tax Information Network of Income Tax Department

- Enter your PAN Card Number

- If you are an individual then enter Aadhaar Card Number

- Enter Date of Birth/Formation/Incorporation

- If you are a business then enter your GSTN Number

- Tick on ‘Terms and Conditions’

- Enter Captcha and Submit

Also read:

Rs.18000 Cr Returned To Banks From Vijay Mallya and Others

Instructions If You Want To Download

- The facility to download e-PAN Card is only available for candidates whose application was processed through NSDL e-Gov.

- PAN applications that have been submitted to NSDL e-Gov and PAN is allotted or changes are confirmed by Income Tax Department within last 30 days, e-PAN Card can be downloaded for free three times for free.

- If PAN is allotted or changes are confirmed by Income Tax Department prior to 30 days then user will have to pay a charge of Rs 8.26 (inclusive of all taxes)

- Income Tax Department has also requested people to link their Aadhaar Card with PAN Card on or before March 31, 2022.