Look At This PPF Calculation To Get ₹2.27 Cr With Monthly Savings

Public Provident Fund (PPF), is a risk-free small saving scheme which is backed by the Government itself. It is assured to provide a large corpus of accumulated funds with interest amounts to its investor after the maturity period. PPF account holders are also eligible to get tax deductions on contributions as well as interest earned under section 80C of the income tax act. But there is a capped limit on the contribution till which it is exempted from Tax liability, which is ₹1.50 Lakh in a financial year. Mostly, investors who love risk-free investments prefer this scheme.

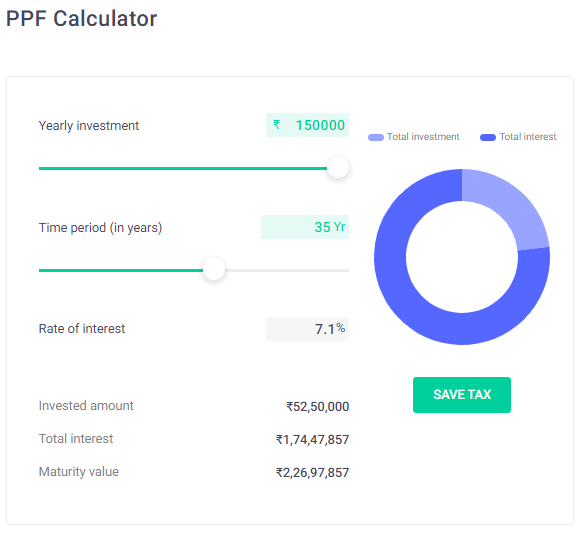

PPF Calculation

At present, the PPF interest rate is 7.10 per cent, which is decided quarterly. So, as per the PPF calculation if the interest rate is sustained at the current pace, and if you invest ₹12,500 per month in your PF account for the next 35 years then you can get a maturity amount of ₹2.27 Cr.

Jitendra Solanki, Tax and Investment expert who is registered with SBI, has informed while explaining the benefit of a PPF account, “Up to ₹1.5 lakh investment is exempted under Section 80C of the Income Tax Act. So, one can avail income tax exemption on up to ₹1.5 lakh per annum.” However, Solanki said that the PPF account maturity period is 15 years and one needs to submit Form 16-H to extend one’s PPF account. “PPF accounts can be extended in a block of 5 years and for that one will have to submit Form 16-H in the 15th year of PPF account opening. Similarly, if an investor decided to remain invested in PPF for the next five years, he or she will have to submit Form 16-H in the 20th year of account opening,” he said.

Also read:

UIDAI Update: A Guide to Check Bank Account Balance using Aadhaar

Note that if you have decided to invest for the next 35 years in PPF then you will have to submit Form 16-H every 15th, 20th, 25th and 30th year of PPF account opening.